8 Things You’ll Never Say Again After Using A Simple Accounting Client Workspace

on 26 January 2024

The work of a CPA involves a lot more than preparing tax returns and providing financial advice—engaging with clients can be its own full-time job!

That full-time job comes with its own set of challenges:

You can never find what you need when you need it. Clients take eons to respond (and when they finally do, they’ve sent the wrong document). The ball gets dropped when you hand off work to other team members.

These age-old problems are nothing new for experienced accountants. But there is a modern solution that helps mitigate them, and it's simple:

You need an accounting client workspace.

Client workspace tools focus on helping accountants and their clients collaborate with one another without the typical headache involved in client engagements. Keep reading to see how client workspaces can help resolve some of the biggest issues your accounting firm faces every day.

Can’t imagine what work would be like without administrative stress? We can show you! Book a free demo of Glasscubes today.

8 Things You’ll Never Say Again Once You Start Using A Simple Accounting Client Workspace

1. “I can’t find [X]!” (Fill in “X” with literally any type of client document you can think of.)

Working with multiple clients means you often have a large number of documents to manage such as invoices, receipts, bank statements, tax forms, and other financial records.

This difficulty can result in delays and inefficiencies as your team spends time searching for the files they need—a situation that negatively impacts productivity and may lead to missed deadlines or incomplete work.

Additionally, misplacing or losing important documents can result in inaccuracies in financial reports or potential compliance issues.

Clients may even lose confidence in your firm’s ability to handle their financial information.

To address this issue, you could try simply establishing a consistent naming convention and folder structure.

A better solution: Implement a simple accounting client workspace (also called a client portal). It enables you to categorize and organize documents, making it easier to search and retrieve specific files. This will improve team productivity and reduce frustration for you and your clients.

In Glasscubes you can…

In Glasscubes you can…

easily share and organize financial documents, tax returns, and reports securely in one centralized location.

No need for manual tracking and searching through numerous email attachments. Everyone will always have access to the latest versions of every document!

2. “Did we receive the latest [X]?” [Yep, same here as above with X.]

Does your team regularly struggle with document tracking and communication delays?

If so, they probably tend to start work with incomplete or inaccurate information. This ultimately leads to errors or omissions in financial reporting, rework, increased turnaround times, and potential client dissatisfaction.

Moreover, the lack of clarity on file receipt can cause delays, as your team may need to spend additional time following up with clients. Inefficient tracking and confirmation of document submissions can also hinder your management ability to accurately assess workloads and allocate resources.

To overcome this challenge, at minimum you need to establish a clear process for receiving and confirming the receipt of important files from clients.

For maximum efficiency, however, use a client portal or secure file-sharing platform where clients can upload and share documents. By having a centralized location for file exchange, you can easily track and monitor incoming files.

In Glasscubes you can…

In Glasscubes you can…

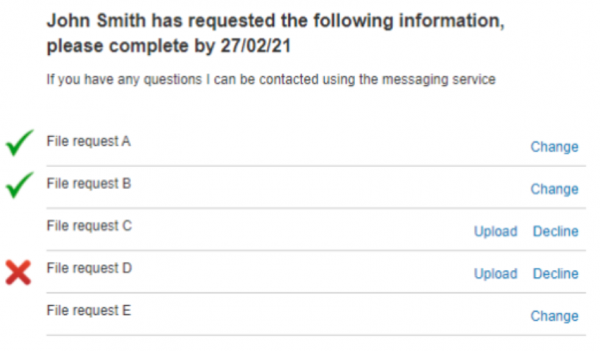

use the file request feature to collect multiple files without having to endure back-and-forth email exchanges. This is an especially useful feature during tax season or audits!

Whether you need 10 documents or 100, collect them all via a single link that navigates to a unique, secure portal where clients can upload the documents you need. Files are checked off as they’re uploaded, so you and clients can easily see progress.

3. “What’s going on with this client?”

Some degree of collaboration is a necessity, but when handing off pieces of work to other team members becomes a challenge, you know something has to be done.

Ineffective delegation can lead to misunderstandings, errors, or inadequate completion of tasks, which can result in delays, rework, or inconsistencies in the quality of work produced.

Plus, a lack of clear communication and expectations can lead to misunderstandings and negatively impact client satisfaction.

Essentially, handing off work without proper documentation or context can disrupt the workflow and efficient completion of tasks, potentially affecting deadlines and overall productivity within your accounting team.

To mitigate these challenges, establish standardized procedures and guidelines for task delegation and handoffs. This includes clear documentation of work progress, deadlines, and expectations.

You can eliminate these issues altogether with project management software or task management tools, which make it possible to digitally assign and track tasks, ensuring transparency and accountability. Regular communication and check-ins with team members can also help to address any issues or concerns that arise during the handoff process.

In Glasscubes you can…

In Glasscubes you can…

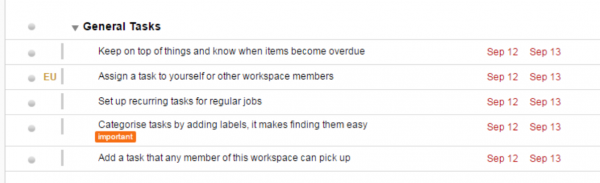

create and assign tasks to clients, other team members, vendors, or any users to which you’ve given appropriate access.

Task reminders and notifications make it easy to convey clear expectations and deadlines, which improves accountability and timely completion of deliverables.

4. “What was the story with this document/client again?”

You may experience out-of-context conversations with clients, where information or discussions lack sufficient background or framing. This can occur due to gaps in documentation, lack of prior knowledge, or incomplete communication.

Without the right context, you may struggle to provide accurate advice or address client queries effectively. Vice versa, the client may not be able to clarify questions you pose.

Either case can lead to misunderstandings, potential errors, or incomplete solutions. Lack of context in conversations can also hinder relationship-building and rapport with clients if they feel that their specific needs or situations are not fully understood.

A helpful practice here is to maintain detailed notes and records of client interactions. This can include recording meeting minutes, documenting emails, and summarizing phone conversations. By centralizing this information in a shared database or customer relationship management (CRM) system, accountants can ensure that all team members have access to the latest information when communicating with clients.

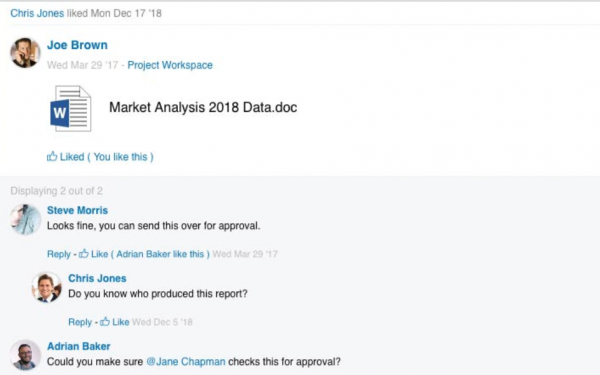

Alternatively, centralizing communications in a simple accounting client workspace can ensure every conversation is contextual. Instead of digging through lengthy email threads or referring to notes, you can start conversations directly from relevant items like files or tasks.

In Glasscubes you can…

In Glasscubes you can…

start threads directly from created tasks, uploaded files, checklist items in file request portals, status updates, and more.

Every response will remain within the context of the item you started it from, ensuring everyone has a relevant reference point to minimize misunderstandings and the need for framing questions.

5. “Dear Client, I’m still waiting for [X]...”

You know the drill—it’s “Dear So-and-so” over and over again until you finally get all the documents you need.

Delayed responses from clients can pose a significant challenge for even the most veteran accounting team. After all, no amount of knowledge or experience can help if clients don’t do their part by providing their financial documents and answering your team’s questions. Such delays can lead to bottlenecks in the workflow, missed deadlines, and added stress to the accountant-client relationship.

To address this issue, set clear communication expectations with clients at the beginning of the engagement. This can include noting required response timeframes, outlining preferred communication channels, and providing reminders for pending requests.

In Glasscubes you can…

In Glasscubes you can…

never chase a document again!

Glasscubes allows you to set up automated reminders for file requests so you can avoid the hassle of manual follow ups with email. Generally, you can send up to 10 reminders on a simple schedule.

If you use the advanced options, the sky’s the limit. Send an unlimited number of reminders with any frequency or on specific days of the year. Even customize messages for each reminder to, for example, indicate greater urgency to meet upcoming deadlines.

In cases where response delays persist despite automated reminders, direct communication can be helpful.

Reach out to clients via phone or video chat to understand the reasons for the delays and work together to find alternative solutions. Building strong relationships with clients and fostering open lines of communication can help reduce the occurrence of delayed responses and ensure smoother client engagements.

Keep all your client conversations, files, and tasks together in one secure accounting client workspace. Book a free demo of Glasscubes today.

6. “I’m sorry for the delay…”

Managing client expectations can be challenging as clients may have unrealistic expectations regarding the scope of work, timeline, or outcomes of financial processes.

Clients may become dissatisfied and unhappy with the services provided, leading to potential loss of business or negative word-of-mouth.

Misaligned expectations can also cause misunderstandings and conflicts between your team and the client, hindering effective communication and collaboration. They may also lead to delays, inefficiencies, inaccurate financial reports, and missed deadlines.

Additionally, managing unrealistic expectations may require additional resources and efforts from you and your team, causing increased workload and potential strain on your firm’s resources.

To tackle this problem, it is important to establish clear and realistic expectations at the beginning of the engagement. This can include discussing the scope of services, explaining the timeline for deliverables, and managing client beliefs regarding results or outcomes.

Regular communication and progress updates throughout the engagement can help to address any concerns or misunderstandings and ensure that client expectations align with the agreed-upon services.

In Glasscubes you can…

In Glasscubes you can…

reinforce expectations.

For example, you can require that all communications with your team go through Glasscubes so that you have greater visibility into everyone’s activities—see what files are uploaded, what tasks are being completed, and who said what and when.

This visibility gives you the information you need to intervene should any issues arise with the client or among your staff.

7. “Has our team completed those compliance tasks?”

Your firm faces the challenge of navigating complex tax regulations and compliance requirements during client engagements. Tax laws are constantly evolving, making it challenging to stay up to date with all the changes and ensure compliance for your clients' financial activities.

If you don’t stay up to date with changes in tax laws, you risk non-compliance, which can result in penalties, fines, or even legal issues. Failure to comply with tax regulations can damage the reputation of both your firm and your clients’ businesses.

Additionally, inaccurate or incomplete tax reporting may lead to missed opportunities for tax deductions or credits, resulting in increased tax liability for the client. The complexity of tax regulations can also increase the time and effort required to accurately prepare tax returns, potentially impacting productivity and leading to longer turnaround times.

To overcome this issue, accountants need to continually educate themselves on tax laws and regulations through professional development and staying informed about updates from tax authorities. Utilizing tax software tools and automation can also help to streamline compliance processes and ensure accurate reporting. Collaborating with tax experts or consultants can provide additional expertise and support in handling complex tax situations.

In Glasscubes you can…

In Glasscubes you can…

ensure your accounting team stays up to date on the latest regulatory requirements by assigning them relevant tasks in Glasscubes.

For example, they may need to attend a seminar, sign up for continuing education, or read industry materials. Detail what they need to do within the task, assign it to applicable team members, and have them mark the task as completed once finished.

8. “Your data may have been compromised as the result of a security breach in our network…”

Your firm regularly handles sensitive financial information, making data security and privacy a significant concern during client engagements.

Protecting client data from security breaches, unauthorized access, or data loss is crucial for maintaining client trust and complying with data protection regulations.

Security breaches or unauthorized access to client data can result in reputational damage, loss of client trust, and potential legal implications. Clients may choose to terminate their engagement if they believe your firm is not taking appropriate measures to protect their data. Furthermore, data breaches can lead to financial loss if sensitive financial information is exposed and exploited.

This is why it’s critical to implement robust cybersecurity measures.

This includes using secure file-sharing platforms with encryption features, regularly updating and patching software, implementing strong authentication processes, and conducting security audits. Staff training on data security protocols and practices is also essential to ensure everyone is aware of their responsibilities in safeguarding client data.

With Glasscubes, you can…

With Glasscubes, you can…

rest assured that your clients’ data will remain safe.

Glasscubes is a secure accounting client workspace. Not only does it protect data by SSL encryption in transit and at rest, but also distributes it across multiple physical locations to ensure high availability and retains it for 30 days.

Glasscubes: A powerful yet simple accounting client workspace for successful client engagements

Glasscubes is a secure client portal and collaboration solution that focuses on helping service providers (like accountants) to reduce their administrative burden while safeguarding their activities.

Our portal is both secure and easy to use. Plus, its multiple capabilities help you work seamlessly with clients to ensure you don’t miss any client files or important tax deadlines.

Imagine being able to:

- Request files without having to nag clients with 20 follow-up emails

- Assign tasks to clients and staff, then track them to completion

- Create and manage an unlimited number of workspaces

- Collaborate in real time wherever your clients are located

- Control who has access to workspaces, files, and more

- Workspace management

Stop imagining and book a demo to see Glasscubes live!

![]() “Saving us hours of resource”

“Saving us hours of resource”

“Prior to using Glasscubes, our whole team was involved in contacting our clients multiple times a year to request their records. This was very time-consuming and was not as successful as we would have liked. We started using Glasscubes this tax year and to date it has saved us around 288 hours of resource, allowing our staff to proceed with actual work. Will definitely be using again in future years.”

—Sophie M, a manager in the accounting industry, via Capterra