How Successful CPAs Manage Client Financial Files

on 22 January 2024

For accountants, one of the most critical aspects of running a successful firm is managing client financial files. The ability to efficiently organize and navigate through these files directly impacts the quality and accuracy of your services.

In other words, mastering document management for client financial information can significantly enhance both your team’s productivity and your client satisfaction ratings.

This article explores the various strategies and tools CPAs, tax preparers, and other finance professionals use to streamline how they organize client files for personal tax returns, monthly bookkeeping, audits, and more. Use the insights shared below to inform your firm’s process for managing client financial files.

Join the legions of accounting professionals who turn to Glasscubes, an all-in-one collaboration solution, for client file sharing. Book a free demo today.

5 Ways CPAs Practice Document Management For Client Financial Information

Regardless of the tools you use at your firm, combining the following approaches and techniques can help you better manage client files.

1. Cloud-Based File Sharing

Many accounting professionals use cloud-based solutions to securely store client files and be able to access them anywhere, anytime. This flexibility enables remote work and collaboration among internal staff and clients even when they are thousands of miles apart.

CPAs can conveniently upload, download, and share files with clients and colleagues via these platforms or portals. Many such tools also offer password protection, limiting access to authorized individuals only.

2. Folder Structure

CPAs often create a well-organized folder structure to categorize and store client financial files. This structure typically includes main folders for each client and subfolders for different types of financial documents, such as tax returns, financial statements, receipts, and invoices.

3. Standardized Naming Conventions

Adopting standardized naming conventions for client financial files is a crucial aspect of efficient and effective organization. These conventions can help avoid confusion and aid in locating specific documents easily.

Naming conventions are typically based on relevant information, such as the name of the client, document type, and document date.

For example, a CPA may develop a standardized naming convention that uses the client name, document type, and document date such as “John Doe Tax Return 2024.pdf.” Another approach is to use a combination of client name, document type, and numeric sequences, which can help ensure that each file name is unique and cannot be duplicated.

4. Document Cross-Referencing

Document cross-referencing is a technique used by CPAs to establish connections between related financial files. It allows users to easily navigate between documents and provides a more comprehensive understanding of the financial information at hand. Here are a few examples of this technique:

- Hyperlinks. By inserting hyperlinks within a document, CPAs can direct users to other related files. For example, within a financial statement, a CPA may include hyperlinks to supporting documents, such as bank statements or invoices, which provide more detailed information. This improves the accessibility and efficiency of document retrieval.

- Notes and annotations. CPAs may also utilize notes or annotations within documents to reference other related files. They can include comments or additional information indicating which other documents are relevant to the current one. This makes it easier for users to cross-reference and locate additional supporting materials.

- Document index. Creating a comprehensive index or inventory of all client financial files is another way to facilitate cross-referencing. The index serves as a centralized reference point, enabling CPAs to quickly locate and access various documents. It can include information such as document names, dates, and specific file locations, making cross-referencing a more organized and systematic process.

5. Backup And Retention

CPAs implement backup procedures to protect client financial data. Regularly backing up files to external devices or cloud storage ensures data integrity and prevents loss due to hardware failure or other unforeseen events. Additionally, CPAs adhere to record retention policies to comply with regulatory requirements.

5 Real-World Examples Of Accounting Document Management & File-sharing

“We use a dedicated client portal that serves as our entire ecosystem for client interactions,” says Jason Moll, a CPA and enrolled agent.

All of his tax preparation clients are onboarded via this solution. Clients are prompted to sign engagement letters, pay invoices, complete tax surveys, upload documentation, and respond to requests directly through the portal.

On the backend, Moll and his team can sort all their clients' files and information in the portal. The portal also has a mobile app that allows them to access client information securely wherever they may be in the world.

“Effective client financial file management is essential to our professional activity as an authorized IRS e-file Provider,” says Hassan Sanders, registered tax preparer and founder of Diabetic Insurance Solutions.

“Our strategy combines cutting-edge technology with a thoroughly planned process to ensure efficiency, precision, and regulatory compliance.”

Sanders uses accounting software to collect and integrate varied financial data from clients. This helps categorize and optimize not only his management of client financial files but the entire firm’s operations.

“Our system can be tailored to specific accounting areas such as tax preparation, bookkeeping, and audits. We tailor our system for unique compliance requirements in tax preparation, assuring correct accounting for required paperwork, deductions, and credits,” Sanders explains.

This tailoring is important as Sanders notes that each tax function has its own nuances.

“For example, tax preparation emphasizes compliance and precision, bookkeeping emphasizes clarity and accessibility, and audits necessitate heightened scrutiny and security.”

Sanders’ approach to handling client financial files is “based on a holistic integration of technology, safe storage, and tailored workflows. This guarantees that individual client needs are met while also conforming to tight regulatory criteria.”

Christopher William, CPA and founder of Balanced News Summary, says his approach to managing and organizing client financial files is based on a combination of traditional filing and digital organization.

He starts by filing original documents in a physical filing system, which ensures he has a clear paper trail for any audits or other situations that may require it.

“From there, I move the documents into a digital filing system for easier access and organization,” says William. “I also use cloud-based software to store client information securely. I can access this information from anywhere, while the system keeps it safe and secure.”

When it comes to different accounting functions, his approach mostly remains the same. However, he does add additional labeling and folder structures to better organize the client’s information.

For example, to organize client files for personal tax returns, he would label each tax return with the year and add them to a folder specifically created for tax returns. This helps keep everything organized and easily accessible.

“Overall, my document management approach is designed to provide a smooth workflow and secure storage of client information,” says William.

The team at Page One Formula manages client financial files by combining cloud-based accounting software with secure file-sharing platforms.

“This setup not only ensures real-time access to client financial data but also fosters efficient collaboration within our team, streamlining our workflow significantly,” says CFO Ian Rodda.

Notably, the team’s approach varies by accounting function. For tax preparation, they use specialized software like TurboTax or H&R Block for accuracy and compliance. Bookkeeping primarily relies on software like QuickBooks for transaction tracking and financial reporting. For audits, they shift to tools like AuditFile or CaseWare, which offer data analysis and risk assessment features.

Dana Ronald, president of Tax Crisis Institute, says his team uses QuickBooks, TurboTax, and e-file services to manage and organize their client's financial files. These technologies have streamlined their workflow and improved the accuracy of our work.

“But the best formula for managing client financial files is first having a system that can generate alerts and notifications to the clients when necessary. This will help keep everything up-to-date and reduce errors,” Ronald explains.

The team’s approach is similar across accounting functions; however, they do customize their services depending on the needs of each client.

“For example, with tax preparation clients, we ensure all necessary documents are in place and offer assistance in filing tax returns. With bookkeeping clients, we focus on organizing their financial records and generating reports for better decision-making.”

Organize client files for personal tax returns, bookkeeping, and more with Glasscubes

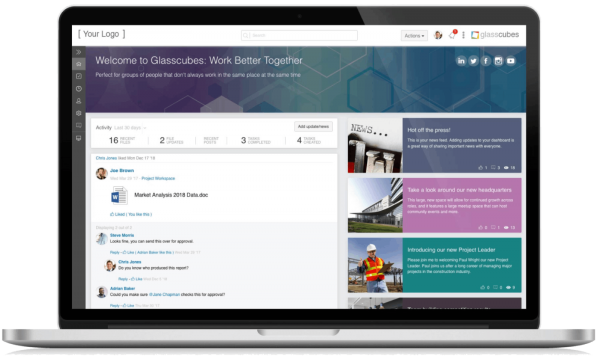

If you want to practice effective document management for client financial information, you need a solution that not only lets you store and share files but also improves multiple areas of collaboration.

Enter Glasscubes, a solution that’s more than just file sharing for accounting—it’s version control, approval workflows, task management, file requests, and many more features that help you work seamlessly with clients to ensure you don’t miss any client files or important tax deadlines.

Here are the key features accountants love about our client portal:

- File sharing and document management

- File request

- Real-time collaboration

- Task management

- Version control

- Audit trails and access control

- Workspace management

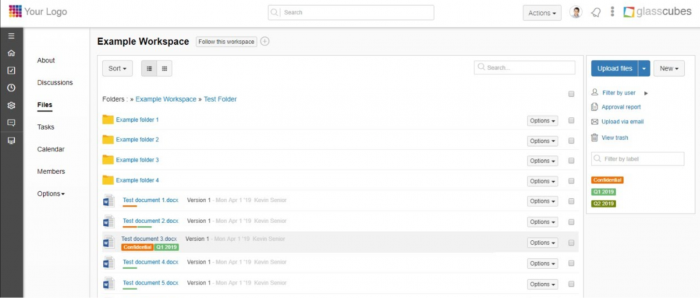

File Sharing And Document Management

File Sharing And Document Management

Easily share and organize financial documents, tax returns, and reports securely in one centralized location.

This eliminates the need for manual tracking and searching through numerous email attachments, ensuring that everyone has access to the latest versions of documents.

File Request

File Request

Avoid the annoyance of emailing clients to collect multiple files (an especially useful feature during tax season or audits!). Whether you need 10 documents or 100, you can collect them all via a single link that navigates to a unique, secure portal where clients can upload the documents you need. Files are checked off as they’re uploaded, so you and clients can easily see progress.

Real-Time Collaboration

Real-Time Collaboration

Communicate and collaborate internally and externally in real time.

This feature eliminates delays and miscommunications associated with email threads.

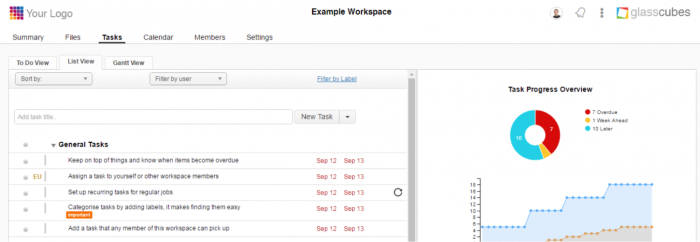

Task Management

Task Management

Create and assign tasks to clients.

Task reminders and notifications make it easy to convey clear expectations and deadlines, which improves accountability and timely completion of deliverables.

Version Control

Version Control

Never again lose track of document versions!

Rest assured that everyone is working on the latest iteration of every document. This mitigates the risks of using outdated or incorrect information.

Audit Trails And Access Control

Audit Trails And Access Control

Automatically record and track all your accounting activities.

Glasscubes provides an audit trail for accountability and compliance purposes. Accountants can control access permissions to determine who can view, edit, or download specific documents.

Workspace Management

Workspace Management

Organize your work with workspaces.

In Glasscubes you can create a workspace for each client and give access to only that client’s team and relevant members of your staff.

“Saving us hours of resource”

“Saving us hours of resource”

“Prior to using Glasscubes, our whole team was involved in contacting our clients multiple times a year to request their records. This was very time-consuming and was not as successful as we would have liked.

We started using Glasscubes this tax year and to date it has saved us around 288 hours of resource, allowing our staff to proceed with actual work. ”

—Sophie M, a manager in the accounting industry, via Capterra

Ready to change your document management system for the better? Request a free demo of Glasscubes today.