Still Doing Accounting Collaboration Like This? Time To Change

on 10 January 2024

Matt Stratman, president of United Tax, knew his team had a communication problem—and he even knew the culprit: email.

For a long time he’d been noticing a recurring challenge across the accountancy with lengthy email threads, fragmented document exchanges, and lost messages. Eventually, he knew the time had come to overhaul the firm’s primary communication system.

“For us, transitioning to a centralized client portal was a pivotal shift to manage client communication and documents,” Stratman explains. The collaboration portal now serves as a comprehensive hub for his team, housing all client-related interactions, correspondence, and financial documents.

The reason for its effectiveness is simple: Client collaboration software gives every member of the team access to a unified client file. “This improves communication, enabling coherent exchanges while granting the ability to review past discussions and interactions at any given point.”

Compared to email, “Ultimately, we found that this centralized approach delivers a superior client experience and streamlines internal operations, allowing us to do better work for our clients,” says Stratman.

When industry professionals search for accounting client collaboration software, Glasscubes always makes the shortlist. See why with a free demo.

Accounting Collaboration: Why Email Doesn’t Work

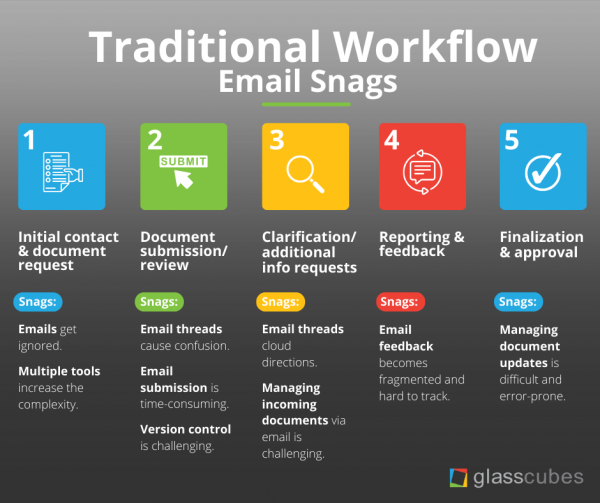

If your accounting firm is experiencing the same challenges as those of United Tax, it’s time (probably past time!) to investigate a fix. To understand why accounting collaboration software is superior to email, let’s first take a look at the problems email introduces in the traditional accounting collaboration workflow.

Below is an explanation of the workflow as described by a number of accounting professionals:

1: Initial Contact And Document Request

Accountant and client collaboration usually begins with the accountant reaching out to the client via email to request specific financial documents or information.

“I usually start by sending an introductory email to the client outlining the services I'll be providing and what information I need from them,” says Sherman Standberry, licensed CPA and managing partner of My CPA Coach.

Julia Kelly, managing partner of Rigits, says this approach aligns with her firm’s process with a few exceptions. “We initiate contact with clients via email to request the necessary financial documents. However, we include a link to our secure portal in the email, which guides them on where and how to upload their documents there instead of attaching it to the email.”

Kelly adds that if it's a new client, someone on her team will also request a phone call with the client and have them upload the documents while speaking with the team member in real time. “We've found that emails requesting documents can often get ignored, especially with clients we haven’t been through this with before.”

While email allows for easy initial contact, drawbacks arise in the form of potential delays and miscommunication. Clients may misinterpret document requirements or overlook important instructions, leading to incomplete or incorrect submissions.

2: Document Submission And Review

“The client then emails me the necessary financial documents,” says Standberry. “This could include a variety of different document types, including bank statements, invoices, receipts, tax forms, etc.”

This step can be time-consuming and error-prone due to the need to manually track and organize multiple attachments from different email threads. It's also challenging to keep documents up-to-date and ensure that everyone has the latest versions, leading to potential version control issues.

3: Clarification And Additional Information

During the review process, accountants often need to seek clarification or request additional information from clients. They send follow-up emails, but the back-and-forth nature of email communication can cause delays and confusion.

Clear instructions can be easily overlooked in lengthy email threads, further complicating the process and potentially impacting the accuracy and timeliness of the work.

For the team at Page One Formula, “Our workflow involves categorizing emails by client and project, setting up automatic filters to manage incoming documents, and scheduling regular check-ins via email to ensure all financial information is up-to-date and accurate.”

4: Reporting And Feedback

After reviewing the documents and completing the necessary calculations and analyses, accountants prepare reports or financial statements for the client. These documents are then emailed to the client for review and feedback.

However, email feedback can be fragmented and hard to track, leading to potential miscommunication or oversight of client concerns or changes. This can create additional rounds of revision and prolong the reporting process.

5: Finalization And Approval

Once feedback and revisions are addressed, the accountant finalizes the documents and sends them to the client for approval.

This step can be cumbersome through email, as there is no centralized system to keep track of document versions. This increases the risk of outdated versions being mistakenly used or important updates being missed, potentially leading to errors and resulting in delays in obtaining client approval.

Email Works Against Collaboration…

Dan Hanley, director at Octane Accountants, says his firm once used email when collaborating with clients. Though his team has since moved on to a more advanced tool, he recalls the troubles email posed.

“When working exclusively via email, our workflow was for the most part limited, transactional, and slow, especially with clients whose communication preferences were for non-email tools,” Hanley explains. “We'd request records, they'd respond in part or in full, and we'd reply with any necessary clarification or detail required to obtain outstanding documents.”

When the work finally began, Hanley notes that communication would continue in this rigid manner. “Both parties would pose their respective questions in email, back and forth. This would culminate, eventually, in the completion of said work in bit-part fashion.

“Far from efficient or enlightening for our clients or us.”

Overall, Hanley says the process was “extremely cumbersome” and ultimately neither party was able to extract any lasting value.

“There was no room for free-flowing exchange of information or conversation, let alone any time remaining within the customer's budget for us to consult with them properly. Not to mention how email isn't a secure method of communication, and so we and our customers alike were very much in the market for a resolution.”

Need a secure accounting collaboration solution that automates file requests and follow-ups? Request a free demo of Glasscubes.

Accounting Collaboration: How To Modernize Your Approach

It’s clear from the above description that the traditional workflow is heavily reliant on an outdated, unreliable tool. Why not take advantage of technological advancements in the form of cloud-based platforms, real-time communication channels, and automation tools to reduce frustration and work more productively?

Hanley’s team did. Eventually, they looked for a tool that would help them prioritize the value they could offer clients when not bogged down by inefficiencies.

“We needed a solution that could enable us to communicate fluidly at all times and reduce time spent on the transactional elements of accountant and client collaboration—namely by automating the process of document request, upload, and follow ups.”

The team found accounting client collaboration software that addressed their needs. “It not only checked off our requirements, but also showcased that it was secure and could move with the times.”

Client collaboration software that is made for accountants offers a number of features your firm can use to its advantage:

- File sharing and document management

- File request

- Real-time collaboration

- Task management

- Version control

- Audit trails and access control

- Workspace management

Glasscubes is an accounting collaboration portal that offers these features and more.

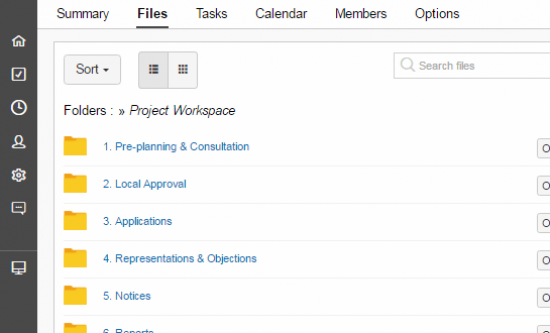

File Sharing And Document Management

Accountants can easily share and organize financial documents, tax returns, and reports securely in one centralized location. This eliminates the need for manual tracking and searching through numerous email attachments, ensuring that everyone has access to the latest versions of documents.

File Request

In Glasscubes, you can avoid the annoyance of emailing clients to collect multiple files, which is especially useful during tax season or during an audit. Whether it’s 10 or 100, you can send a single link that navigates to a unique, secure portal where clients can upload the documents you need. Files are checked off as they’re uploaded, so you can and clients can easily see progress.

Real-Time Collaboration

Glasscubes allows for instant communication and collaboration between accountants and clients. This feature enables real-time discussions, feedback, and clarification, eliminating delays and miscommunication associated with email threads.

Task Management

Accountants can create and assign tasks to clients, ensuring clear expectations and deadlines. Task reminders and notifications help keep everyone on track, improving accountability and timely completion of deliverables.

Version Control

With Glasscubes, accountants can keep track of document versions, ensuring that everyone is working on the latest iteration. This mitigates the risks of using outdated or incorrect information.

Audit Trails And Access Control

Glasscubes records and tracks all activities within the platform, providing an audit trail for accountability and compliance purposes. Accountants can control access permissions, determining who can view, edit, or download specific documents.

Workspace Management

In Glasscubes, you can create an unlimited number of workspaces, each with a unique subset of users. For example, you can create a workspace for each client and give access to only that client’s team and relevant members of your staff.

By leveraging these features, you can streamline your collaboration processes, increase efficiency, reduce errors, improve communication, and enhance client satisfaction.

“[Glasscubes is] saving us hours of resource”

“Prior to using Glasscubes, our whole team was involved in contacting our clients multiple times a year to request their records. This was very time-consuming and was not as successful as we would have liked. We started using Glasscubes this tax year and to date it has saved us around 288 hours of resource, allowing our staff to proceed with actual work. Will definitely be using again in future years.”

—Sophie M, a manager in the accounting industry, via Capterra

Ready to ditch email? See how our accounting collaboration software creates a smooth, easy workflow minus the headache. Request a free demo of Glasscubes today.